India As A Cashless Economy

Jul 24, 2019 • 19 views

A cashless society refers to an economy where all financial transactions take place through the exchange of digital and electronical money, rendering all form of physical money such as banknotes or coins obsolete. With the advent of payment formats such as Paytm, Apple Pay and Samsung Pay, India is making great strides towards becoming a fully functioning cashless society.

Knowing the Government’s goals for our economy, lets look at some of the pros and cons associated with a cashless society.

Pros

1) Lower cost of printing money – A cashless economy which utilizes less hard money will mean the government will have to print less money and hence save a massive sum. The money saved by the government on seigniorage can be put to well use in industries like infrastructure, healthcare and education, which India desperately needs.

2) Less Black Money – One of Modi Government’s primary initiatives with the economy was to develop a way to stop the use of black money, leading to the demonetization policy in 2016. A cashless economy will result in all money being monitored by the respective banks, leading to no opportunities for harbouring black money.

3) Less Petty Crimes – Since citizens will no longer have a need to carry any money with them on their person, the amount of muggings and petty crimes going in the cities is also sure to decrease. This will be especially helpful for India as cities such as Mumbai and Delhi have extremely high crime rates.

Cons

1) Difficult in Implementation – India has a majority of its population uneducated and living in the rural region. The country will first have to develop a way to educate the mass public about how to go about using digital transactions and how they operate. Furthermore, the government will also have to set up high speed connections in order to allow the users to actually use the product, and this will most likely take a long costly time.

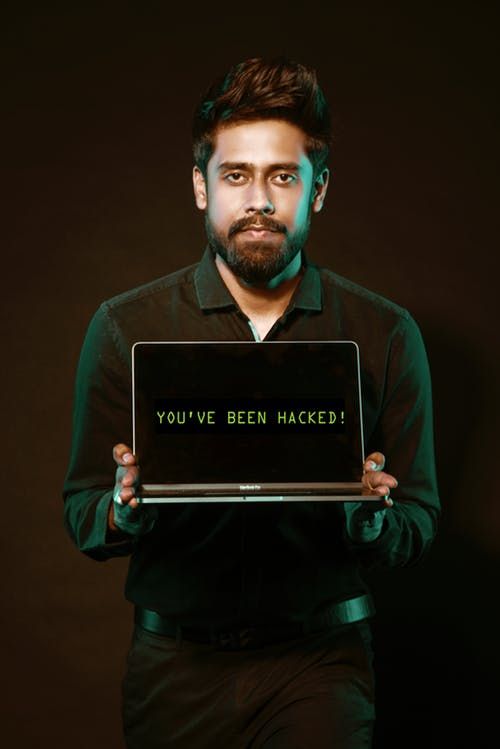

2) Dangers of hacking – Another downside of going completely cashless would be the dangers of being hacked, A citizen’s entire private data will be stores with the government and the hacker will be able to access all of it. What’s even worse is that unlike normal crime, it will be far more difficult to trace and arrest a hacker.

3) Increase in Inequality – A large portion of the Indian population remains unbanked even to this day and age, A

system such as this, which relies heavily on banking and technological availability, is sure to create even more disparity between the poor and rich of the country