A Look At Trickle Down Economics

Jul 18, 2019 • 10 views

Trickle Down Economics refers to a subsection of Supply Side Economics, which opts for tax cuts on the richer section of society, believing the benefits will trickle down to all sections of society. It suggests cuts in income tax, business tax, dividends taxes etc. will help business owners and investors engage in more endeavours, for example investing greater amounts in exchange markets and taking on more projects to expand business operations. This will in turn boost the economy, resulting in more employment, income etc. for all sections of the society.

Trickle Down economics, and in a sense supply side economics, were invented by economist Arthur Laffer, who uses the Laffer Curve to justify his theory. He also claims that taxes must lie in a prohibitive range in order for the cut in taxes to boost economic growth to a satisfactory level.

Previous uses in history

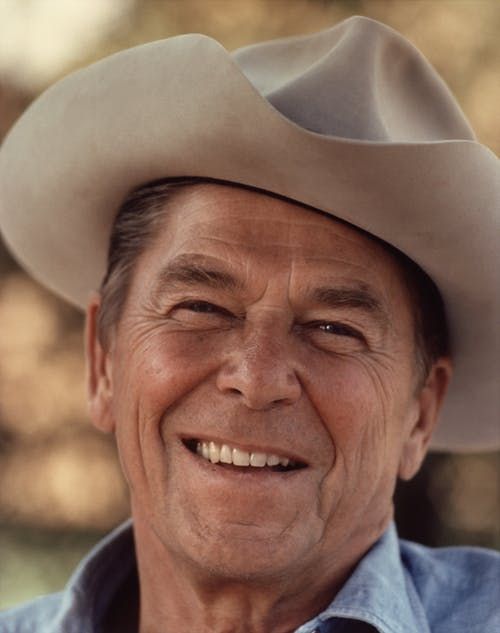

Reagan Administration – More commonly known as Reaganomics, the trickle down concept was used by American President Ronald Reagan in order to end the recession that took place in the 1980s. Reagan reduced the tax Reagan introduced 2 tax cuts to those of the highest personal income category, reducing it from the original 70% to 50% in 1981 and then further reducing it to38.5% in 1986 which fell to an even lower 28% in the subsequent years. He also changed the capital gains tax and the corporate tax rate. While this greatly helped Reagan out of the recession, critics of the theory also point out that Reagan greatly increased Government Expenditure at that time, mainly in Defence in order to end the Cold War.

George W Bush Administration – President Bush also employed the use of trickle down economics in order to curb the Recession in 2001. Bush employed similar strategies to Reagan in his tax reforms. He used 2 major reforms, one focusing primarily on Income taxes (Economic Growth and Tax Relief Reconciliation Act) and the other aiming to raise employment and encourage business (Jobs and Growth Tax Relief Reconciliation Act). While Bush did manage to guide the country out of the recession, there were also other factors at play. The FED had also cut interest rates from 6% to 1%, thus it may have very well been monetary roles that played a part in the economic growth.

Present Time Use

President Donald Trump seems to be a big advocator of the trickle down economics policy, introducing his own “Tax cuts and Jobs Act” reform, in which he made a permanent reduction to corporate tax from 35% to 21% and introduced more income rate tax cuts. While he claims the economic boost will be more than enough to offset the growing debt faced by America, many economists have come forward to point out the shortcomings of his plan.

So will Trickle Down Economics work its magic again? Or will economists be right in proving its fault in theory? Only time can tell.