Growth Of Music Industry In India

Jun 09, 2019 • 50 views

In 2018, Indian music industry rose by 24.5% with a revenue of $156 million (₹1068 crore). According to a report by IFPI, India currently ranks 15 and is expected to be in the top 10 of the biggest music industries by 2022.

HISTORY OF MUSIC INDUSTRY IN INDIA

The history of Indian music industry dates back to 3rd and 2nd Millennia BC around the time of Indus Valley Civilization. Indian music is associated with rhymes and melodies but is also concerned with vibrant colors of the musical heritage. Many archaelogists do analysis and give evidences of the presence of various musical instruments like harps, drums and flute in the period.

According to the Indian mythology, laws of music were known as Narada, the first sage. It is also believed that the first singer was ' Tumburu ' and the Goddess of Music and Learning is Ma Sarasvati.

The rules of theatre, known as natyashastra were breated by Bharata between 200 BC and 200 AD. It describes the rhythmic elements of Indian music that are Gardharva music and Talas.

PRESENT SCENARIO

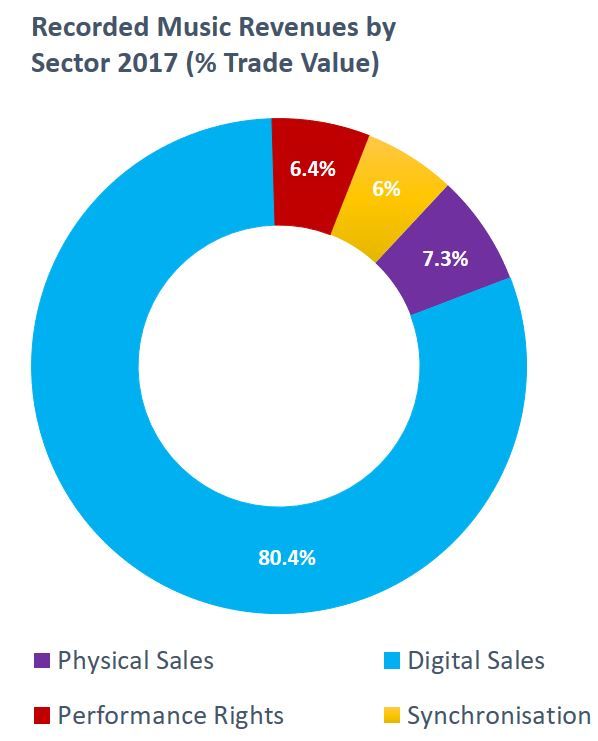

The global recorded music grew by 9.7% in 2018. FAccording to the figures in Global Music Report 2019, total revenues for 2018 were $19.2 bn driven by an uptake in paid streaming (32.8%). The Asia and Oceania region (11.8%) grew to become the second-largest region for combined revenue ( physical and digital ) , with strong growth in South Korea (17.7%) and India.

Streaming proceeds grew by 34.4% and contributed to almost half (47%) of global revenue, driven by a 32.8% rise in paid subscription streaming. There were 256 mn users with paid streaming services by the end of 2018, with paid streaming contributing 36% of total recorded music revenue. Growth in streaming more than balance a 10.2% fall in physical revenue and a 21.3% fall in download revenue.

Illustrating global growth, India has observed an increase in streaming revenue (31%) with increasing traffic towards appropriate sources of music (audio platforms, video streaming platforms, etc.) driven by an rise in smartphone infiltration and low data rates. The penetration of music services to tier two and three cities, along with an rising subscriber base of internet users suggests that the potential for growth for audio streaming consumption (and therefore, revenues) remains huge – as proritised by the rising competition in the audio OTT industry. Physical revenues, on the other hand, grew only by 21.2% and synchronization revenues by 24.6%