Money Management : The Everyday Crisis

May 28, 2019 • 49 views

Is it the end of month and you are low on cash or you cannot go on that holiday trip because you cannot afford it or you had to cancel that lunch because you are having a deficiency of vitamin money? Imagine what it would be like to have that extra bit in your wallet at the end of month or to breathe in peace because you are finally debt free.

Let’s find out all the tips and tricks that will help saving money.

1.Home sweet Home

As we all know, charity begins at home. Planning to save money and fulfilling the demands of every family member doesn’t always go hand in hand.

Let’s find out how to save money at home

Always start with a budget planner: Prepare for the whole month in advance and cut down on those extras that you have been spending of late. Sort your priorities and list down the amount you want to spend on each of them. Going by the budget will not only help you save some money but also make your haywire life a bit disciplined.

Switch to street shopping: You always don’t have to buy branded materials or products just because a bunch of people who don’t even know you will go wow. So simply go out with your family for shopping. There is a huge chance you will find lots of stuff of great quality at a low price.

Prefer home cooked food: Never opt for street food or restaurants over home food because a) they are not healthy and b) they cost a lot of money.

It’s sometimes okay to say no to your kids: Your kid can sometimes manage with that old (still working absolutely fine) toy rather than the new expensive one. It will help you save money and make your kid realise the importance of things and money.

Have long term and short term goals: Always set goals on why you want to save money, that way it will easier for you to do so. Short term goals include vacation, buying a car etc. and Long term goal include retirement plan, Student loan.

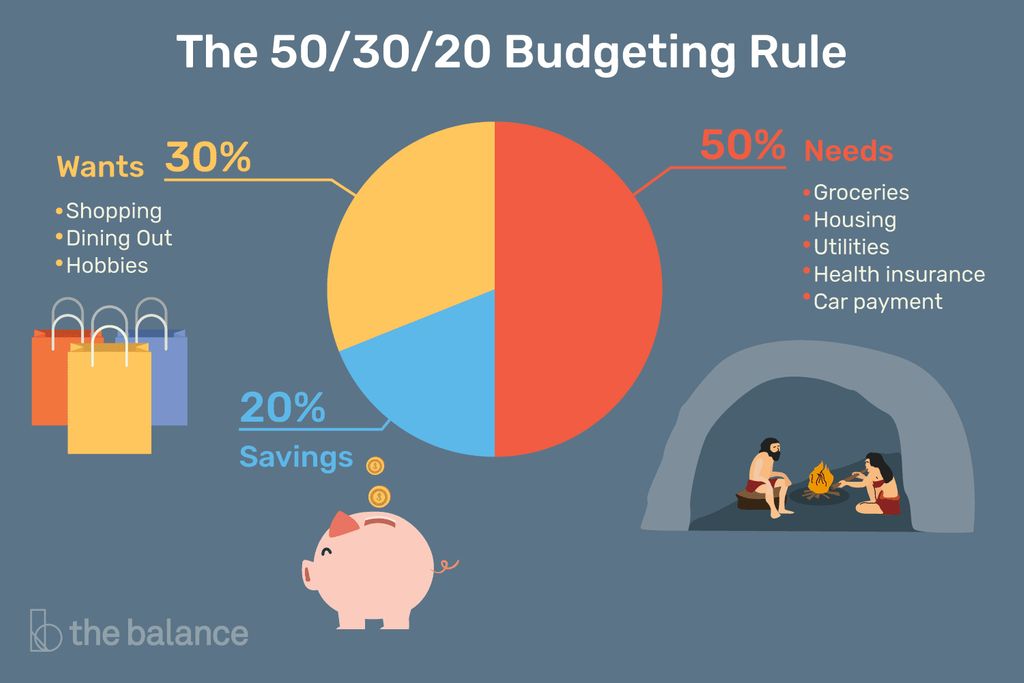

2.The 50/30/20 plan

Pic source : Google images

One of the great ways to save money is to follow the 50/30/20 budget plan. Start by dividing your after tax income into needs, wants and savings.

Needs: These are the must haves that are absolutely necessary for survival. Spend 50% of your income on them.

Wants: These are also important but not as necessary as needs. These include movies, thosenew shoes, holiday trip etc. Spend 30% of your income on them.

Savings: Allot the rest 20% of your income to savings and investments. This includes addingmoney to an emergency fund in bank saving account or investing in stock market.

3.Monthly savings

Let’s look at the ways on how to save money monthly.

Cut Monthly bills: You can opt for lower price cable connection, reduce your energy costs by not wasting electricity and save as much water as possible thereby aiding the environment along with yourself.

Control excess spending: As already mentioned above, stick to your budget plan that will help you keep track of your money.

Invest under right tax shelter: Consult the right people and make good investments that can help your money grow.

Cut down on luxuries: You can always opt for that fuel efficient car rather than the classy looking high maintenance one. You can always choose a mediocre brand for clothes rather than going for the high-end brands. Air-conditioners can be used only when absolutely needed and your 2 expensive beers a day could always be added to your savings.

“When money realizes that it is in good hands, it wants to stay and multiply in those hands.” - Idowu Koyenikan

It is important to control reckless spending and to stop living week to week. Start by getting rid of a bad habit by replacing it with a good one.

You don’t have to be Scrooge from Christmas Carol to save money, there are multiple ways to do so. With proper planning and maybe a little compromise you can master the art of money saving.