Effects Of Currency Depreciation On The Economy Of India

Mar 27, 2019 • 13 views

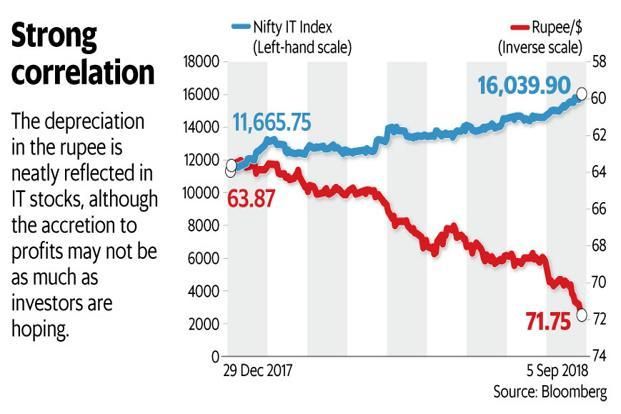

There are some who argue that a weak rupee will make exports more competitive and thereby spur exports of goods and services. A weaker currency alone cannot boost a country’s export while a gradual, non-disruptive depreciation as part of a wider trade strategy can be beneficial in the long run. In the current context, a depreciated rupee may not help much in boosting exports due to four key reasons.

~First, the ongoing currency depreciation is not unique to India. The currencies of many other EMEs are also depreciating concurrently. Some competing EMEs have witnessed even greater depreciation in their currencies.

~Second, the recent episodes of rupee depreciation had no significant positive impact on Indian exports. During the ‘taper tantrum’ episode of 2013, Indian rupee lost 20 percent of its value, but that did not result in significantly higher exports.

~Third, a large segment of India’s merchandise exports (such as gems and jewelry, chemicals, and textiles) has a very high import intensity due to their dependence on imported inputs.

~Fourth and more importantly, it is not easy to stimulate exports through currency depreciation when the global demand is sluggish. As global demand is expected to remain subdued in the next few years, India’s export prospects are limited.

Falling rupee will keep bond yields at a higher level and may force authorities to raise interest rates—high interest rates can arrest the fall by attracting foreign capital. This, however, will adversely impact long-term debt funds as their net asset value(NAV) and returns fall when interest rates go up. In addition, it will affect the performance of the government bond schemes in the NPS. Higher interest rates will also hurt borrowers. So, your home loan EMIs could go up.

The rupee can strengthen against another currency when it requires more of that currency to buy a rupee than before. It can weaken against another currency when it requires more rupees to buy a unit of that currency than before.

When the rupee is set to strengthen, more people will be willing to invest in rupee-denominated assets. If the rupee is set to weaken, fewer people will want to invest in rupee-denominated assets.

If the rupee strengthens, importing things into India becomes cheaper, and exporting things from India becomes more expensive. If the rupee weakens, Indian exports become cheaper and Indian imports become more expensive.