Mutual Funds

Jul 01, 2019 • 3 views

The year 2011-12 witnessed main fold regulatory approaches towards the development and growth of mutual fund industry in India and the developmental goals were addressed by providing provisions for infrastructure debt funds bringing depth in terms of allowing new class of investors that is the qualified foreign investors and new investment avenues for fund manager by enabling repo transactions in corporate debt securities.

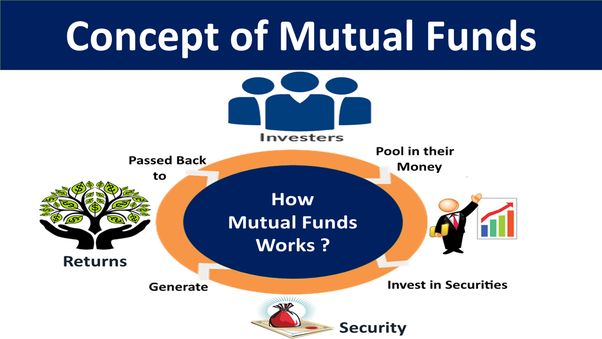

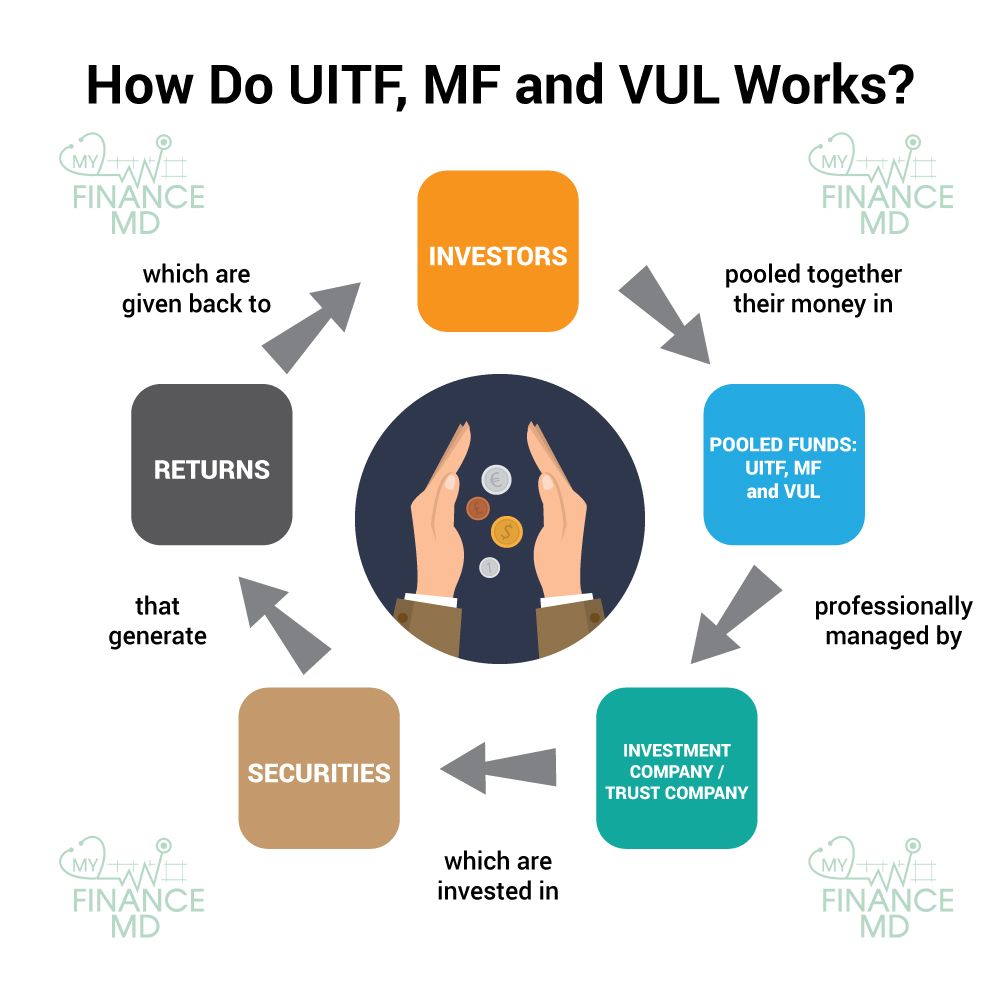

Mutual funds is a form of collective investment that is useful in spreading risks and optimizing returns for an ordinary investor, the advantage of a mutual fund is that it brings a wide variety of security within the rich of the most modest of investors. The mutual fund companies collect money from investors in a smaller denomination and then based on their market knowledge and research, money is invested in various instruments of investment, viz, shares, debentures, bonds, etc. U-turns are then distributed among the investors after deducting the administrative expenses, they make up for investor's lack of knowledge and awareness and the mutual funds are regularly required to announce Net Asset Value of each scheme.

The scheme can be open-ended or closed-ended. In the open-ended schemes the investors have the opt-out at any moment but in the closed-ended schemes, an investor can make an exit only after a fixed period of time. Similarly, the schemes are designed so as to give regular income, cumulative growth or both. The investment priorities of the scheme are announced in the prospectus, specifying where all the investments will be made. All the mutual funds are asked to strictly adhere to portfolio disclosure, standardization of accounting policies, valuation norms for Net Asset Value band pricing. The mutual funds are regulated and supervised by SEBI which ensures investor protection facilitating competition imparting a greater degree of flexibility and promoting innovation.

The financial sector has a vital role in promoting efficiency and growth, it intermediates the flow of funds from those who want to save a part of their income to those who want to invest in productive assets. The width, depth, and diversity of the Indian financial system have increased recently.

To access and read the creditworthiness of the companies and their financial instruments service rating companies, viz, CRISIL and ICRA have come up. The company? According to its strength and acts as guiding aids for the investors.

In India, lack of proper regulation has helped several scrupulous companies dupe the investors, these fly-by-night operators have damaged the capital market forcing millions of people to the time tested and fully secure bank and post office deposits provident funds and government securities. The medium to the long term debt market and short term money market in India are relatively segmented and underdeveloped, it's in the interest of both savers and those who invest in productive assets that the capital market in India became developed.