Warren Buffett's Investment Tips

May 02, 2019 • 10 views

Warren Buffett is regarded as one of the most sucessfull investors of our age. When it comes to investments, the only one person who you need as a mentor is Warren Buffett. So here are some of Warren's investment strategies that will surely take off your investment game.

1) Cash Is A Bad Investment:

Warren Buffett always lays stress on getting more into Assets Rather than getting into cash. Cash doesn't make you anything. It's value either remains constant or decreases for sure over time. If you really want your investment game to Grow, You need to invest more in assets which will over time generate you more revenue.

2) Seize The Opportunity at Right Moment:

Mr.Buffett says that we have abundance of opportunities surrounding us. The reason why most of us cannot realise those opportunities is that we are not observant enough. We dont really have to have an opinion about everything that we go through. We need to have knowledge and opinion about only a handful of things. When we have the correct knowledge and we use it to seize the opportunity that is present around us just in the right moment, we create success.

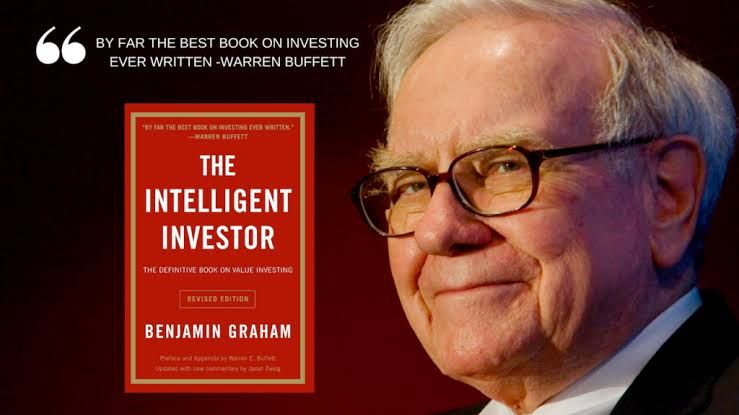

3) "The Intelligent Investment"

This is something Mr.Buffett has always laid stress on. He even prefaced a book The Intelligent Investor which is still a best selling book for all aspiring investors and entrepreneaurs. He explains this like " if you assemble all the gold of the world, it would make a cube of gold of side 67 feet. It would value to aprox. 3 trillion dollars. Now, with this much money, you could buy all the farm lands of The United States and yet have approximately a Trillion dollars with you. If you would ask me to either chose to sell that gold and invest that money in those farm lands which in course of time will generate me more revenue or keep that gold which would obviously make me nothing, i would choose the farms."

4) Evaluate Your Investments:

Warren Buffett lays great emphasis on studying about the company of asset before you invest your money in it. He himself practises this act and only invests his money in a company if that asset multiplies his investment to a significant amount over a course of time.

5) Accept Your Mistakes:

This is something not only for the investors but every single one of us. Accepting our mistakes and taking full responsibility of out mistakes will not only make us more responsible, but more aware as well. If we have no one to blame for our mistakes then we naturally become more concious of our activities and the results are improved.