Why You Should Invest In Stock Market?

Apr 01, 2020 • 28 views

35 years ago, if you had invested Rs. 10,000, today it would be worth Rs. 600,00,00,000. Yes! you read that right. Many readers might not believe it or some may even say it to happen pretty rarely but it is all facts. As you read you'll find why it is more beneficial to invest in Stock Market rather than to let your money sit in a savings account and eventually lose its value.

You should not be left behind

Warren Buffet once said,

“If you don’t find a way to make money while you sleep, you will work until you die.”

Stock Market is indeed risky and you might lose money but take a note here, that the instruments which you take as "safe options", whether it's your savings account or FDs, and think your money is safe then here's a fact, you'll lose money, in fact, a lot. You might ask how's that possible? Well, the returns you get in a savings account or FD's are taxed and taking inflation in an account, your returns will get reduced or even zero.

Grow Your Money

When you do it right, you can grow over 15% to even 20% per year over the long term, Just like the example, I gave you in the beginning.

The point is not the specific returns, those will all differ greatly from person to person.

The more important point here is that money can grow much larger over time if you choose the stock market over traditional savings instruments.

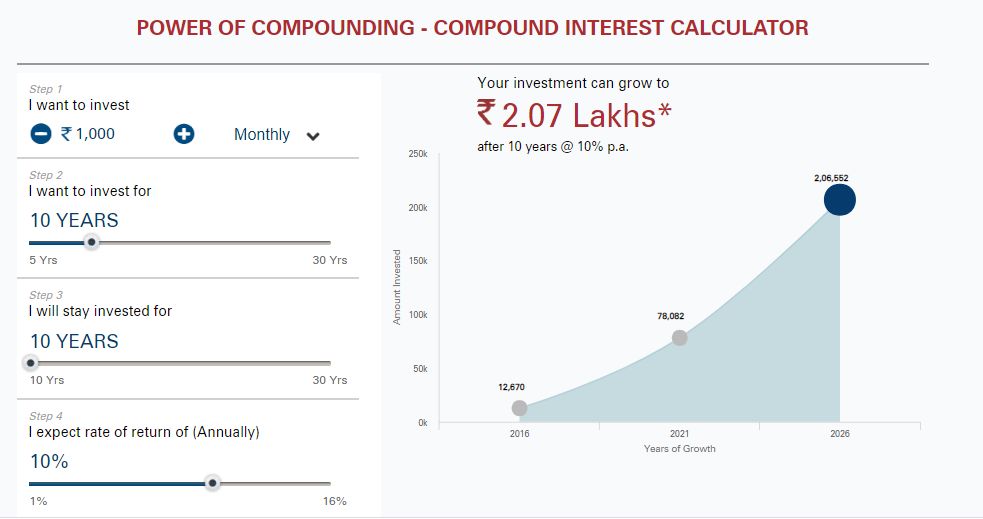

Power of Compounding

Compounding interest simply means the interest on interest. When you earn a certain interest on your principal amount, it is added to the original amount, which then becomes the principal for the next cycle.

This allows exponential growth for your interest. Suppose, you invest ₹ 1000 in a bank that offers 10% interest per annum. Your investment becomes ₹ 1100 after the first year, then ₹ 1210 after 2nd year and so on.

Don't have to be a Brainiac

An experienced investor might have an advantage over you as you're just getting started, but you surely don't have to be a brainiac, rich, or another Warren Buffet to start investing. You have to take out enough time to research the companies that you're considering investing, you can find public data such as annual reports poking around their respective websites, and understanding of basic maths will do the work.

Take your time

There's no hurry to rush in right now and invest in the stock market. Do your homework, be realistic about goals and don't over expect. Figure out the way to make the best use of the information available to you.