The Big Bull Scam

May 01, 2019 • 332 views

“Know what you own, and know why you own it.”

Ever tried to know about the personality who created a massive stroke to the stock market of India in early 90’s

Harshad Shantilal Mehta, who was born in a typical Gujarati family to a small businessman. He completed his degree in Lala Lajpat Rai College and worked under different companies as a broker analyst in many firms. During his works, he was more interested in stock markets and later he joined as a broker for B. Ambalal, JL Shah, Nandala Sheth.

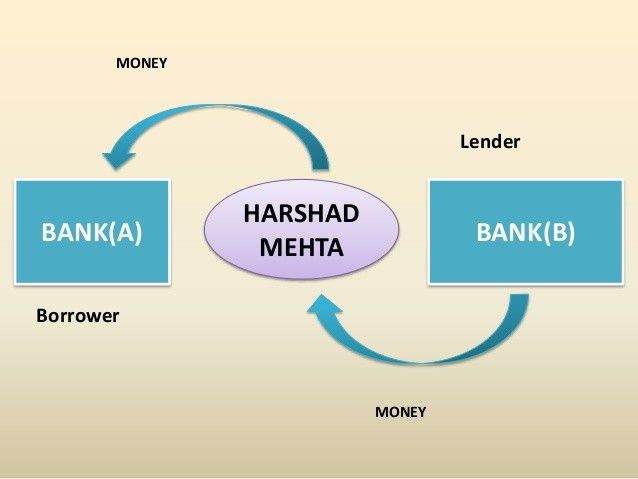

In 1984, he started his own firm with his brother named “GrowMore Research and Asset Management”. This was initially huge success with effective functioning of top management. The seed of scam initiated with the concept of “Ready Forward Deal”, where the government issues securities in the form of bond and for the need of the liquidity it was kept as a pledge to the banks for short period. If the pledged banks also were in need of liquidity they can take liquid cash from other banks. The brokers of Harshads firm act as mediators for this transaction, for which took time searching of other banks to avail the liquidity. They started creating more demand for these and gained a lot by personal time allotment. In those days, as per RBI guidelines amount should be transferred as per the receiving bank but Harshad Mehta started taking cheques on his name and adjusted with its requirement.

He turned so greedy that he created fake receipts of government securities for which bank used to issue amount at a large base fund and started investing in stock market. For e.g. He started to trade heavily of ACC (Associated Cement Company) shares where its price increased from Rs.200 to Rs.9000. Mehta justified this excessive trading in ACC shares by stating that the stock had been undervalued, and that the market had simply corrected when it revalued the company at a price equivalent to the cost of building a similar enterprise; the so-called "replacement cost theory" that he had put forward.

During this period, especially in 1990-1991, the media portrayed a heightened deified image of Mehta, calling him "The Big Bull". He was on cover page of a number of articles including the popular Economic magazine Business today, titled "Raging Bull". His flashy lifestyle of a sea facing 15,000 feet penthouse in the tony area of Worli complete with a mini golf course and swimming pool, his fleet of cars include a Toyota Lexus, Corolla Starlet, Toyota Sera were also flashed in publications. These further exemplified his image all at ones which were rarities even for the rich people of India.

At that time he was called by different top business magazines as the “Amitabh Bachchanof Stock Market”.

In criminal indictments later brought by the authorities, it was alleged that Mehta and his associates then undertook a much broader scheme, which resulted in manipulating the rise in the Bombay Stock Exchange. The scheme was financed by supposedly collateralized bank receipts, which were in fact uncollateralized. The bank receipts were used in short-term bank-to-bank lending, known as "ready forward" transactions, which Mehta's firm brokered. By the second half of 1991 Mehta had earned the nickname of the 'Big Bull', because he was said to have started the Bull Run in the stock market. Some of the people who worked in his firm included Ketan Parekh, who later would be involved in his own replicate scam.

A typical ready forward deal involved two banks brought together by a broker in lieu of a commission. The broker handles neither the cash nor the securities, though that wasn't the case in the lead-up to the scam. In this settlement process, deliveries of securities and payments were made through the broker. That is, the seller handed over the securities to the broker, who passed them to the buyer, while the buyer gave the cheque to the broker, who then made the payment to the seller. In this settlement process, the buyer and the seller might not even know whom they had traded with, either being known only to the broker. This the brokers could manage primarily because by now they had become market makers and had started trading on their account. To keep up a semblance of legality, they pretended to be undertaking the transactions on behalf of a bank.

Having figured out his scheme, Mehta needed banks which issued fake BRs (Not backed by any government securities). "Two small and little known banks – the Bank of Karad (BOK) and the Metropolitan Co-operative Bank (MCB) – came in handy for this purpose. These banks were willing to issue BRs as and when required, for a fee," the authors point out. Once these fake BRs were issued, they were passed on to other banks and the banks in turn gave money to Mehta, assuming that they were lending against government securities when this was not really the case. This money was used to drive up the prices of stocks in the stock market. When time came to return the money, the shares were sold for a profit and the BR was retired. The money due to the bank was returned.

This went on as long as the stock prices kept going up, and no one had a clue about Mehta's operations. Once the scam was exposed, though, a lot of banks were left holding BRs which did not have any value – the banking system had been swindled of a whopping ₹40 billion (US$630million). He knew that he would be accused if people came to know about his involvement in issuing cheques to Mehta. M J Pherwani of UTI was also linked to Mehta.

On 23 April 1992, journalist Sucheta Dalal exposed Mehta's illegal methods in a column of The Times of India.

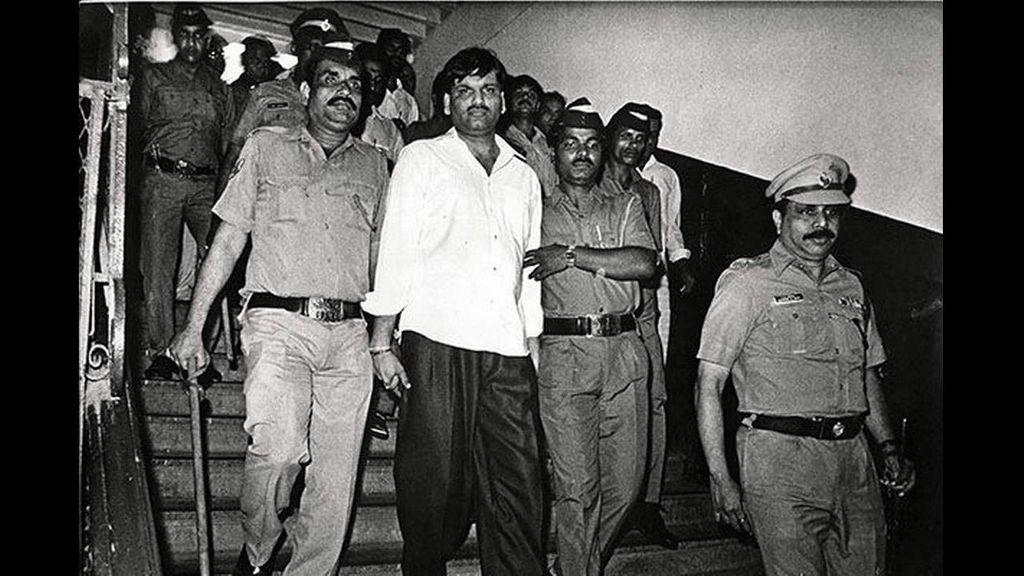

Chairman of Vijaya Bank committed suicide after the scam disclosure. Mehta was arrested by CBI on 9th Nov 1992 and charged 600 civil action suits and 70 criminal cases. At that situation he used to live a luxury life by paying 26 crores of tax to Indian Government.

Mehta was under Criminal custody in the Thane prison. Mehta complained of chest pain late at night and was admitted to the Thane civil Hospital. He died following a brief heart ailment, at the age of 47, on 31 December 2001. As the whole world was about to welcome the New Year, he left the world. He is survived by his wife and one son. He died with many litigations still pending against him. He had altogether 28 cases registered against him. The trial of all except one, are still continuing in various courts in the country. Market watchdog, Securities and Exchange Board of India (SEBI), had banned him for life from stock market-related activities.

A 2011 wikileaks document revealed that Harshad Mehta had funds of ₹ 135,800 Crore (1,358,000,000,000) / ₹ 1358 Billion in thirteen sub accounts with UBS AG, a Swiss bank.