The Phenomena Of Copy And Social Trading

Jul 18, 2019 • 18 views

Social trading is a newly developed trading strategy which allows investors to observe and understand the trading techniques and behaviour employed by other investors investing on that social trading platform.

This has led to the rise of copy trading or mirror trading, in which inexperienced individuals may simply copy or replicate investment strategies that top level expert investors utilize, in order to gain the same profit as them without having the skill or expertise.

For example, Person A has no experience or knowledge about investing in the stock market while person B has spent a majority of his life learning and trading stocks. If they operate on the same social trading platform then person A can simply copy the portfolio movements of person B i.e. if B invests 1% of his total portfolio money I IBM stocks then A’s portfolio automatically does the same.

The first social trading platform was eToro, created in 2010. Following that, many new platforms have emerged such as ZuluTrade and Wikifolio which also double as online brokerage sights, each offering their own tools to copy and observe other traders’ behaviour.

While this may seem like a dream opportunity for those not well versed in the financial markets to make some quick cash, through no apparent effort of their own, researchers have found that individuals who mimic the pattern of the top investors actually end up having a net loss. Let’s look into a few reasons why this might occur:

1)The Disposition effect

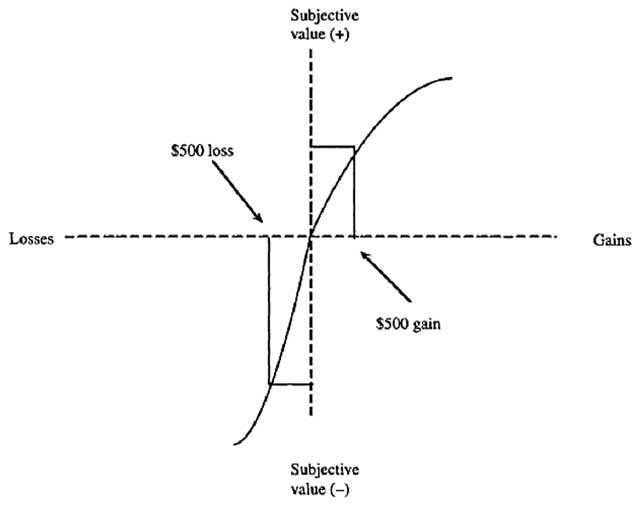

This refers to a behavioural phenomenon suffered by traders in which they have a tendency to hold onto assets which are depreciating in value and have a quicker tendency to sell assets which are appreciating in value. This effect is found to be even more prominent in the top traders of such social platforms due to them feeling a higher level of responsibility over their investments and hence not willing to give up on losing investments.

2)Risky Strategies

Generally the top traders are investors who opt for the riskiest strategies in return for the most gain. While this may put them on the top of leader boards, any intelligent investor willbe aware that this strategy is not one that’s going to last for a long time. Thus, eventually when these “risk everything” strategies end up failing, they bring everyone down with them.

The advent of Social Trading has certainly been an interesting one and may still be a very valid form of investing despite its many shortcomings. In the future, citizens may even start looking at this type of investing path in the same light as Mutual Funds and Hedge Funds.