Inflation

Jun 02, 2019 • 38 views

'Prices of commodities especially consumer goods are quite alarming.'

Inflation is an economic problem globally & hogged the headlines daily. Inflation refers to the rise in general price level of commodities over a period of time. A situation of havoc is created among people, especially the poor who will not be able to afford the necessities of life. However, inflation is not always a bane for a nation. It indicates that a nation is prospering if income of people are increased commensurately. In periods of depression, the government deliberately tries to raise aggregate demand in the economy,thereby aggravating the prices.

Effects

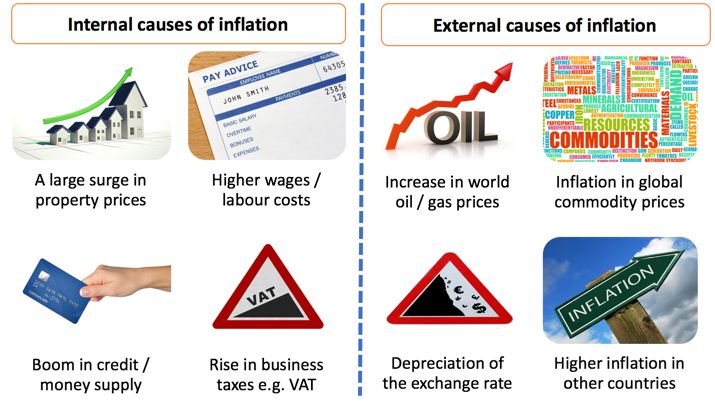

But in most instances, inflation is caustic to society. Inflation may arise due to increase in money supply. National debt is also a contributing factor to inflation. Rise in national debt either leads to an increase in taxes, thereby increase in prices by business enterprises or increase in money supply to pay off debt.

This causes devaluation of domestic currency in relation to foreign currency. Rise in input prices also lead to high price level. Cost of living increases & demand-pull effect also beget inflation. Increase in demand with supply remaining same leads to inflation. There is no check over spending of government. High fiscal deficit leads to inflationary & wage-price spiral.

Hyperinflation

Hyperinflation is a situation in which monthly prices exceeds by more than fifty percent. The consequences of hyperinflation are more severe & adverse. Many countries have experienced hyperinflation. One classic example is of Venezuela. Prices rises by million dollars & tackling the situation becomes a tiring & near to impossible job. Some countries even have to abolish their own domestic currency & adopt US dollars. Even a newspaper cost a fortune. Price signals & transaction system are badly affected during the time of hyperinflation. Thus, hyperinflation is even worse than inflation.

Controlling Measures

Steps by RBI in form of monetary policy is being taken to combat it. Rich are becoming richer & poor more poorer. 2-3% of inflation rate per year is considered as healthy. It helps in regulating the labour market properly. CRR & SLR needs to be increased in cases of inflation. Repo rate should be increased, ultimately leading to rise in bank rate of interest. Margin requirements should be raised & rationing of credit should be done. Strict policies should be followed by banks while granting loans. RBI can sell securities to reduce cash flow. Government also frames it's a fiscal policy in regard to the situation of the economy. Higher taxes, low public expenditure is being done to control inflation. Skyrocketing prices is a grave concern for society & inflation needs to be tackled globally.