How Food Delivery Services Are Changing Indian Restaurants??

Jan 18, 2019 • 9 views

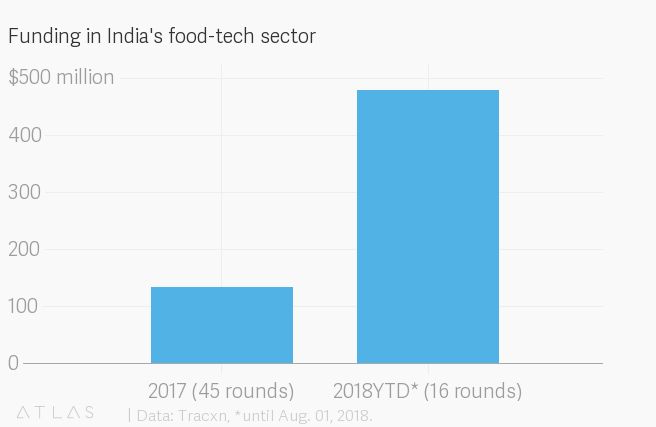

In India, dining out is giving way to “eating in” as fast-food chains latch on to food-delivery startups.

Besides urban dining habits, food-aggregator apps are even transforming restaurant chains’ view of their own businesses.

For instance, in July this year, tea retailer Chai Point launched a new cafe in Bengaluru with a layout unlike any till now: It has an area demarcated for food-delivery apps’ personnel.The chain now plans to replicate this design, laying emphasis on delivery aggregators, at most of its new outlets.

Global food brands likeMcDonald’s and Kentucky Fried Chicken (KFC), too, are bolstering their tie-ups with food aggregator startups like Zomato and Swiggy, even setting up separate teams to manage these platforms.

Last month, India’s largest homegrown coffee shop chain,Café Coffee Day (CCD),launched a virtual restaurantat its existing outlets to cater only to orders fromUberEats, the food-delivery arm of the cab-hailing app Uber.

Bengaluru-based Swiggy hosts over 45,000 restaurants on its platform.But the market is still in its infancy as aggregators form a small part of the delivery business—at Chai Point, just a quarter of all online orders come from food-aggregating apps. Yet, the “uberification” of the sector is potentially transformational. “Now we even take decisions on opening new stores based on data from our aggregation partners.”

Restaurant chains are also pairing up with aggregators for marketing campaigns. Recently, Subway tied up with Swiggy to deliver over a lakh sandwichesacross its 400 outlets, the restaurant chain said in a Nov. 15 statement.

Not all is milk and honey

Recently, the Food Safety and Standards Authority of India (FSSAI) pulled up aggregators for hosting unverified outlets on their platforms. The watchdog asked them to ensure “training and capacity building of restaurants for improving food safety and hygiene rather than focusing only on deep discounts and aggressive marketing.”

Profit-marring deep discounts and the lack of safety checks have cast a shadow on the survival chances of the aggregators in the long run.Restaurants, therefore, are cautious not to be overly reliant. “We can look at them from a two-year horizon as long as they are well-funded and then once that runs out, who knows where they will be?”.